Stock Market LIVE Updates: GIFT Nifty signals weak open; Asian markets fall; Ola Electric in focus

Original Source:

Read full article at source

Original Source:

Read full article at sourceFood delivery giant Talabat has reported full year adjusted profit of $451 million -- that's a jump of 15% year on year. The Dubai-headquartered firm plans to invest $100 million this year to grow its subscriber base across its verticals. Toon Gyssels, CEO, Talabat spoke to Bloomberg’s Horizons Middle East and Africa anchor Joumanna Bercetche on their performance and competition from other delivery apps. (Source: Bloomberg)

The UK aims to showcase AI's transformative potential at the AI Impact Summit in New Delhi, emphasising its role in economic growth, public services, and job creation. Delegates will also explore partnerships with India to ensure inclusive benefits from AI advancements.

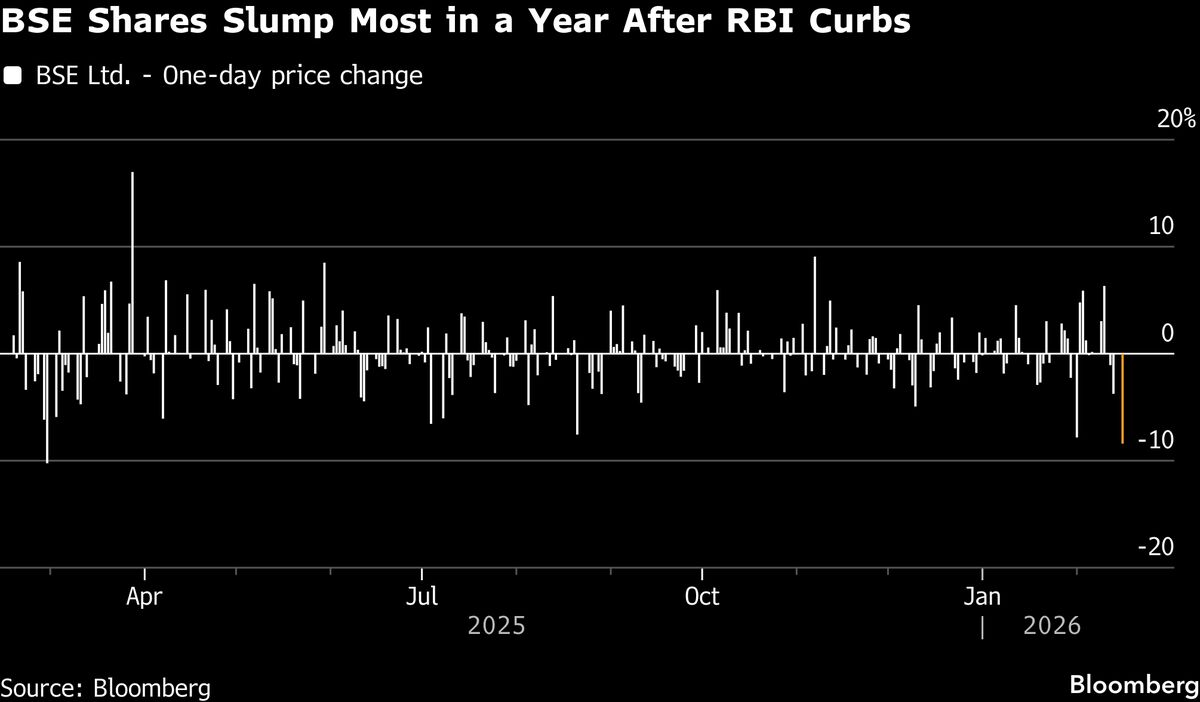

India’s $5.2 trillion stock market has had a soft start to the year, and it could face further pressure as new regulatory measures to moderate trading activity add to existing concerns about corporate profit growth and foreign flows.

Satellite images cited by ‘The New York Times’ show expanded nuclear sites in Sichuan Province, including near Zitong and Pingtong. Analysts link the buildup to China’s superpower ambitions, as US officials raise concerns over testing and a growing warhead stockpile.

Takehiko Nakao, former Japanese Vice Minister of Finance for International Affairs, says a Bank of Japan rate hike will help yen levels and that it would be good for Takaichi's administration and the central bank to be more aligned in economic goals. He discusses his outlook for fiscal policy, and monetary path forward for Japan. He speaks with Shery Ahn on "Bloomberg: The Asia Trade". (Source: Bloomberg)

We use cookies to enhance your browsing experience, analyze site traffic, and serve personalized ads. By clicking "Accept", you consent to our use of cookies. You can learn more about our cookie practices in our Privacy Policy.