Finance

Finding a Commonwealth Bank Near Me

Finding a Commonwealth Bank near me can save you time and effort. This article will guide you through the process, services, and benefits of finding a Commonwealth Bank branch in your vicinity.

Finding a Commonwealth Bank Near Me

Finding a Commonwealth Bank Near Me

The Importance of Proximity

Having a Commonwealth Bank branch nearby can be a game-changer. It means easy access to various banking services, personalized assistance, and a sense of security knowing your bank is just around the corner.

The Commonwealth Bank Locator

Commonwealth Bank provides a user-friendly branch locator on their website and mobile app. By simply entering your postcode or suburb, you can discover the closest branches and ATMs.

Using ATMs

With a bank near you, you can easily access Commonwealth Bank’s extensive network of ATMs without incurring additional fees. This is especially beneficial when you need quick cash.

Commonwealth Bank Services

Everyday Banking

Discover a wide range of services for your everyday banking needs. From savings accounts to credit cards, a nearby Commonwealth Bank branch can help you manage your finances effectively.

Home Loans

If you’re considering buying a new home or refinancing, a local branch can provide expert advice on Commonwealth Bank’s home loan options, interest rates, and repayment plans.

Financial Planning

Planning for your future becomes more accessible when you can visit a Commonwealth Bank financial planner close to home. They can help you with investments, superannuation, and retirement planning.

Benefits of Having a Local Branch

Personalized Assistance

When you have a Commonwealth Bank near you, you can benefit from personalized assistance from friendly and knowledgeable staff. They can address your concerns and guide you through complex transactions.

Enhanced Security

In case of any issues or emergencies, having a local branch means you can visit in person and speak to a bank representative, enhancing the security of your finances.

Community Engagement

Commonwealth Bank branches often participate in community events and initiatives, creating a sense of belonging for both customers and employees.

Frequently Asked Questions (FAQs)

Is there a Commonwealth Bank near me?

Yes, Commonwealth Bank provides a branch locator tool on their website and mobile app, making it easy to find a branch in your vicinity.

Can I access my account at any Commonwealth Bank branch?

Yes, you can access your account at any Commonwealth Bank branch, not just your home branch.

Are there fees for using Commonwealth Bank ATMs?

No, using Commonwealth Bank ATMs is fee-free for Commonwealth Bank customers.

How can I reach Commonwealth Bank customer support?

You can reach Commonwealth Bank customer support through their 24/7 helpline, even if your nearest branch is closed.

What are the operating hours of Commonwealth Bank branches?

Operating hours may vary by branch. Check the branch locator or call your nearest branch for specific hours.

Can I open an account at any Commonwealth Bank branch?

Yes, you can open an account at any Commonwealth Bank branch. Simply visit the nearest one with your necessary documents.

Commonwealth Bank Near Me: Your Convenient Banking Solution

Having a Commonwealth Bank near you offers a myriad of benefits, ensuring your banking experience is both hassle-free and rewarding. Here’s a more detailed look at why proximity to a Commonwealth Bank branch is a valuable asset.

Accessibility at Your Fingertips

One of the standout advantages of having a Commonwealth Bank near you is the accessibility it provides. With a local branch, you can easily take care of your banking needs, whether it’s depositing a check, withdrawing cash, or seeking financial advice.

Face-to-Face Financial Consultations

When you’re making significant financial decisions, nothing beats a face-to-face consultation with an expert. A nearby Commonwealth Bank branch offers you the opportunity to sit down with a financial advisor who can provide tailored guidance on your financial goals, whether it’s planning for a major purchase, investment, or retirement.

Branch-specific Offers and Promotions

Commonwealth Bank often runs location-specific promotions, making your local branch the gateway to exclusive offers and discounts. Keep an eye out for deals tailored to your area, which can help you save money and take advantage of specialized services.

Building Relationships

Your local branch is not just a place to manage your finances; it’s a place to build relationships. The staff at a nearby Commonwealth Bank branch get to know you, understand your unique financial situation, and can offer personalized solutions that cater to your needs.

Exceptional Customer Service

Proximity to a Commonwealth Bank branch means that you can experience exceptional customer service. The staff at these branches are well-trained, courteous, and always ready to assist you with any queries or concerns you may have.

Accessibility to Business Services

For business owners, having a local Commonwealth Bank branch is a significant advantage. You can access business services such as business loans, merchant services, and business accounts with ease.

Investment Opportunities

If you’re interested in investments, having a local branch can be particularly beneficial. You can discuss various investment options with an expert, explore potential opportunities, and receive valuable insights into the ever-changing world of finance.

ATMs Galore

Access to Commonwealth Bank ATMs is a breeze when you have a local branch. These ATMs are not only abundant but also fee-free for Commonwealth Bank customers. It’s a convenience that can save you time and money.

In conclusion, the benefits of having a Commonwealth Bank near you go beyond mere convenience. It’s about having a financial partner that understands your needs, offers tailored services, and provides you with expert guidance. Use the branch locator to find the nearest Commonwealth Bank branch, and start enjoying all these advantages today.

Finding a Commonwealth Bank Near Me

Finance

Exploring the Financial Future Together – The Collaborative Journey of HDFC and Lord Abbett in Creating LHA (Lord & HDFC Investment Advisor)

In this dynamic era, the perfect unio between Indian brokerage HDFC and American investment firm Lord, Abbett & Co. LLC marks a groundbreaking partnership in the world of finance. This collaboration not only signifies the deep cooperation between two major financial institutions but also heralds an exciting foray into the Indian market.

HDFC: A Financial Titan in the Indian Landscape

HDFC, as one of India’s largest brokerages, has consistently played a leading role in the Indian financial market. Its rich experience, extensive industry knowledge, and have broadly define the services. As a pillar of the Indian financial system, HDFC has been dedicated to providing comprehensive financial services to clients, witnessing and leading India’s economic rise.

Lord Abbett & Co. LLC: The Savvy Global Investment Firm

Across the Atlantic, Lord, Abbett & Co. LLC shines as a brilliant star in the American financial investment sector. Established in 1929, Lord Abbett has been committed to delivering superior fixed-income and global equity investment strategies to investors worldwide. Headquartered in Jersey City, New Jersey, the company has a profound global investment experience and a presence in multiple international financial hubs.

Financial Brain Trust: Chief Financial Analyst Vijay Sharma and Financial Analyst Karan Mehra

Vijay Sharma: A Visionary Leader in Finance

As the Chief Financial Analyst for the HDFC and Lord Abbett collaborative investment classroom, Mr. Vijay Sharma is not just a financial elite but also a leading figure in the Indian financial market. Born in Delhi, India, he is a research scholar from the University of Cambridge, holding a Ph.D. in Finance and a Master’s degree in National Economic Strategic Investment.

Over the past 20 years, Mr. Vijay Sharma has focused on global stocks and commodities trading, accumulating extensive investment experience. In 2012, he and renowned investment guru Mr. Vijay Kedia accurately predicted the beginning of a golden bull market in the Indian stock market, providing valuable guidance to Indian investors. Combining his rich experience at Eminent Capital Management and J.P. Morgan, Mr. Vijay Sharma has been recognized as one of the top ten outstanding strategic financial analysts in the UK.

Karan Mehra: Integrating International Experience into the Indian Market

Karan Mehra, at the age of 35, serves as a Senior Financial Analyst at Lord, Abbett & Co. LLC. Born and raised in Delhi, he developed an early passion for finance, leading him to pursue a Master’s degree in Finance from Harvard University in the United States. Karan Mehra worked in various international financial institutions such as Goldman Sachs and J.P. Morgan, specializing in investment analysis and asset management,collecting extensive industry experience and professional skills. In 2018, he joined Lord, Abbett & Co. LLC, becoming a Senior Global Financial Analyst for this esteemed international financial institution.

In 2024, Karan Mehra’s career took a significant turn when he was sent back to India, marking a crucial moment in his professional journey. He began applying his experience and knowledge from international markets to India’s rapidly growing financial market. Karan Mehra has excelled in asset investment planning and stock investment analysis, dedicated to helping Indian citizens establish solid investment strategies in an increasingly complex and volatile market environment.

The role of this financial think tank extends beyond financial analysis. They actively engage in community education and financial literacy initiatives, aiming to help more Indians understand and participate in the stock market, enhancing their financial knowledge and investment capabilities. They believe that through education and proper guidance, even ordinary Indian investors can achieve success in the stock market and wealth growth.

Our Goal and Vision:

1.Guide the Indian people on how to profit in the stock investment market.

2.Provide accurate investment insights, different investment portfolios, and effective wealth accumulation.

3.Open the doors to success for all knowledge seekers, offering a platform to fulfill their desires by earning more money.

4.Devote to expanding prosperity in the Indian market, aiming for it to become the world’s third-largest economy by 2030.

Why Choose Our Investment Classroom?

1.Exceptional Partnerships: The powerful collaboration between HDFC and Lord Abbett provides students with deep insights and real-world experience.

2.Global Perspective, Local Wisdom: Combining HDFC’s strong foundation in India with Lord Abbett’s global investment experience, we offer students a broader perspective and more precise investment wisdom.

3.Investors’ Home: Our classroom is not just fertile ground for knowledge but also a home for investors to grow together. Here, you are not just a student but an investor passionate about achieving excellence.

4.Join us in shaping the future and forging excellence together.

Finance

The 92Career Revolution: Navigating Future Paths with Confidence

In a world where 92career choices abound, finding the right path can be overwhelming. Traditional approaches to career exploration often fall short, leaving individuals perplexed and unsure about their professional journey. Enter 92Career, a revolutionary platform that goes beyond conventional career services, providing users with a personalized roadmap to success.

The Evolution of Career Exploration

The Traditional Approach

Traditional career exploration often involves generic assessments and limited insights into specific professions. This outdated method lacks the personalization needed for individuals to make informed decisions about their future.

The Need for Innovation

With the evolving job landscape, there is a pressing need for innovative solutions that consider the unique skills, aspirations, and preferences of each individual. 92Career steps into this space, offering a fresh perspective on career discovery.

Understanding the 92Career Platform

Features and User Interface

92Career boasts a user-friendly interface, making it easy for users to navigate through various features. From skill assessments to comprehensive career profiles, the platform ensures a seamless experience.

How it Differs from Traditional Career Services

Unlike traditional services, 92Career leverages advanced algorithms and machine learning to provide accurate and personalized career recommendations. The platform adapts to the burstiness of individual preferences, offering dynamic suggestions.

The Power of Personalized Career Recommendations

Algorithms and Machine Learning

92Career’s algorithms analyze vast datasets, considering factors such as skills, education, and industry trends. This results in tailored recommendations that align with each user’s unique profile.

Matching Skills and Aspirations

The platform goes beyond merely suggesting professions; it delves into the specifics, matching users with roles that align with their skills, passions, and long-term aspirations.

Career Pathways Unveiled

Exploring Diverse Professions

This opens doors to a plethora of professions, enabling users to explore options they may not have considered otherwise. From creative industries to STEM careers, the platform covers a wide spectrum.

Real-world Insights from Industry Experts

To enhance the user experience, 92Career integrates real-world insights from industry experts, providing a glimpse into the day-to-day realities of different professions.

Success Stories from 92Career Users

Personal Growth and Achievements

Users share stories of personal growth and professional achievements, crediting 92Career for guiding them toward fulfilling careers.

Navigating Challenges with 92Career

Challenges are inevitable, but 92Career equips users with the tools and resources needed to overcome obstacles on their career journey.

How 92Career Promotes Lifelong Learning

Continuous Skill Development

The platform encourages continuous learning, offering resources for skill development to keep users competitive in a rapidly changing job market.

Adapting to Industry Changes

In an era of constant change, This empowers users to adapt to industry trends, ensuring they remain relevant and sought after by employers.

Busting Myths About Online Career Platforms

Security and Privacy Concerns

Addressing common misconceptions, This prioritizes the security and privacy of user data, implementing robust measures to protect sensitive information.

Validating the Credibility of 92Career

Users can rest assured knowing that 92Career is a trusted platform, validated by industry experts and backed by a track record of success.

Navigating the 92Career Dashboard

Step-by-Step Guide for New Users

For those new to the platform, a step-by-step guide ensures a smooth onboarding process, helping users set up profiles and explore the wealth of features.

Optimizing Profile Information

Maximizing the benefits of this involves optimizing profile information, allowing the platform to fine-tune recommendations based on user preferences.

Future Trends in Career Exploration

The Role of Technology

As technology continues to shape industries, It stays ahead of the curve, integrating the latest advancements to provide users with cutting-edge insights.

Global Opportunities with 92Career

The platform transcends geographical boundaries, opening doors to global opportunities and connecting users with careers on an international scale.

User Testimonials: Voices of the 92Career Community

Positive Experiences and Transformative Journeys

Users share their positive experiences, detailing how 92Career has transformed their lives and helped them discover careers they are truly passionate about.

Constructive Feedback and Continuous Improvement

The platform values user feedback, using it to drive continuous improvement and ensure that this remains a leader in the field of online career exploration.

Challenges and Solutions in the Career Discovery Process

Addressing Common Concerns

From uncertainty about career choices to concerns about job stability, It addresses common challenges, providing solutions to help users navigate their career paths with confidence.

Enhancements for a Seamless User Experience

Feedback-driven enhancements contribute to a seamless user experience, ensuring that this evolves in response to the changing needs of its users.

Empowering the Next Generation of Professionals

Educational Partnerships and Collaborations

92Career collaborates with educational institutions, creating pathways for students to seamlessly transition from education to the workforce.

Preparing Students for the Future Workforce

With a focus on preparing students for the future, 92Career equips them with the skills and insights needed to excel in a rapidly evolving job market.

The Social Impact of 92Career

Contributing to Economic Development

By connecting individuals with meaningful careers, This contributes to economic development, fostering a workforce that drives innovation and growth.

Fostering Inclusivity and Diversity

This prioritizes inclusivity and diversity, ensuring that individuals from all backgrounds have equal access to opportunities and resources.

Conclusion: Embracing Career Possibilities with 92Career

In a world where career choices are vast and varied, 92Career stands out as a beacon of guidance and support. Embrace the possibilities that this innovative platform offers, and navigate your career path with confidence, backed by personalized recommendations and a supportive community.

FAQs (Frequently Asked Questions)

- Is my data secure on 92Career?

- Yes, This prioritizes the security and privacy of user data, implementing robust measures to protect sensitive information.

- How does 92Career differ from traditional career services?

- Unlike traditional services, 92Career leverages advanced algorithms and machine learning to provide accurate and personalized career recommendations.

- Can 92Career help me explore careers outside my current field?

- Absolutely! This opens doors to a plethora of professions, enabling users to explore options they may not have considered otherwise.

- Is 92Career only for students, or can working professionals benefit too?

- 92Career caters to both students and working professionals, offering personalized career guidance regardless of your career stage.

- How often does 92Career update its features and content?

- It values user feedback and continuously updates its features to ensure a dynamic and evolving platform.

Finance

Alternative Investments A Lucrative Path to Diversify Your Portfolio

Introduction

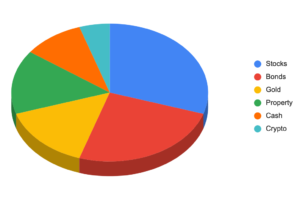

In today’s dynamic financial landscape, investors are constantly seeking opportunities to diversify their portfolios beyond traditional assets like stocks and bonds. Alternative investments have emerged as an enticing option, offering unique avenues for wealth creation and portfolio optimization. In this comprehensive guide, we delve into the world of alternative investments, exploring their various types, benefits, and considerations. By the end, you’ll have a deeper understanding of alternative investments and how they can play a pivotal role in your investment strategy.

Understanding Alternative Investments

Defining Alternative Investments

Alternative investments encompass a diverse range of assets beyond traditional stocks, bonds, and cash equivalents. These investments typically include real estate, private equity, hedge funds, commodities, venture capital, and more. While alternative investments may carry higher risk profiles compared to traditional assets, they offer the potential for enhanced returns and improved portfolio diversification.

The Appeal of Alternative Investments

- Enhanced returns: Alternative investments often have the potential to deliver higher returns compared to traditional asset classes. By exploring alternative investment opportunities, investors can tap into lucrative markets and niche sectors that may outperform conventional investments.

- Portfolio diversification: One of the primary benefits of alternative investments is their ability to diversify your portfolio. Unlike traditional assets that tend to move in tandem with broader market trends, alternative investments often exhibit low correlation, providing a cushion against market volatility and potentially reducing overall portfolio risk.

- Access to unique opportunities: Alternative investments grant access to specialized sectors and strategies that are not readily available in traditional markets. From investing in startups and early-stage companies to acquiring tangible assets like real estate or commodities, these opportunities offer unique avenues for growth and wealth accumulation.

Types of Alternative Investments

Real Estate

Real estate has long been a popular alternative investment due to its potential for long-term appreciation and the opportunity to generate passive income. Investors can explore different avenues such as residential properties, commercial buildings, real estate investment trusts (REITs), and real estate crowdfunding platforms.

Private Equity and Venture Capital

Private equity and venture capital involve investing in privately held companies at various stages of development. These investments often offer significant growth potential but may require a longer investment horizon. Private equity funds and venture capital firms specialize in identifying promising companies and providing capital in exchange for equity stakes.

Hedge Funds

Hedge funds are investment vehicles managed by professional fund managers. They employ diverse strategies, including long-short equity, global macro, event-driven, and quantitative approaches. Hedge funds often target higher net worth individuals and institutional investors, providing access to sophisticated investment strategies and potentially attractive risk-adjusted returns.

Commodities

Investing in commodities such as precious metals, energy resources, agricultural products, or even water rights can act as a hedge against inflation and provide diversification benefits. Commodities can be accessed through futures contracts, commodity-focused mutual funds, or exchange-traded funds (ETFs).

Cryptocurrencies

Cryptocurrencies, led by Bitcoin, have gained significant attention as alternative investments in recent years. These digital assets operate on decentralized networks and offer the potential for substantial returns. However, it is crucial to note the volatility and regulatory considerations associated with this emerging asset class.

Considerations before Investing in Alternative Assets

Risk Assessment

Before delving into alternative investments, it is crucial to assess your risk tolerance, investment objectives, and time horizon. Alternative investments often involve higher risk compared to traditional assets, so a thorough evaluation of your financial situation and risk appetite is paramount.

Due Diligence and Research

Conducting thorough due diligence is vital when investing in alternative assets. This entails researching the investment opportunity, understanding the underlying risks, analyzing historical performance, and evaluating the credentials and track record of fund managers or investment

firms. This meticulous research process helps ensure that you make informed investment decisions and select reputable opportunities that align with your investment goals.

Liquidity and Lock-Up Periods

Alternative investments often come with different liquidity terms compared to traditional assets. Some investments, such as private equity or real estate, may have longer lock-up periods, limiting your ability to access funds immediately. It is essential to consider your liquidity needs and evaluate the time commitment required for each alternative investment.

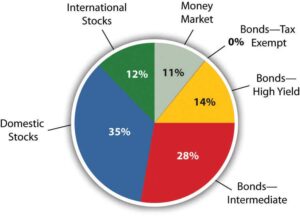

Diversification and Asset Allocation

While alternative investments can enhance portfolio diversification, it’s crucial to strike the right balance. Consider your overall investment portfolio and align alternative investments with your existing asset allocation strategy. Diversification across different asset classes can help reduce risk and optimize potential returns.

Professional Guidance

Navigating the world of alternative investments can be complex, especially for novice investors. Seeking professional guidance from financial advisors, wealth managers, or investment professionals with expertise in alternative assets can provide valuable insights and help you make informed decisions aligned with your financial goals.

Conclusion

Alternative investments offer an enticing opportunity for investors to diversify their portfolios, seek enhanced returns, and access unique markets and strategies. Whether it’s investing in real estate, private equity, hedge funds, commodities, or cryptocurrencies, alternative assets provide a pathway to broaden your investment horizons. However, it is crucial to approach alternative investments with caution, conducting thorough research, assessing risk tolerance, and considering your overall investment strategy. By incorporating alternative investments thoughtfully into your portfolio, you can potentially unlock new avenues for long-term growth and financial success.

-

HEALTH2 years ago

HEALTH2 years agoDr. Naval Parikh: Thyroid Disease Signs, Symptoms & Treatment Options

-

HEALTH2 years ago

HEALTH2 years agoDr. Naval Parikh: Back Injuries, Types, Causes, Symptoms and Treatment

-

FASHION12 months ago

FASHION12 months agoBest Color Shoes for Men: Making a Style Statement

-

TECH2 years ago

TECH2 years agoHow to Turn Flashlight On iPhone & Off, 3 Easy Ways

-

TRAVEL1 month ago

TRAVEL1 month agomyfavouriteplaces.org:// Blog | Travel’s Best-Kept Secrets

-

Celebrity2 years ago

Celebrity2 years agoDay 3 of Spring 2016 New York Fashion Week’s most inspiring

-

GAMES2 years ago

GAMES2 years agoAbout Tekken 3

-

HEALTH8 months ago

HEALTH8 months agoTop 5 Best Activities For Well being